If you’re running a care service, pay close attention—April 1, 2025, marks a major shift in the UK’s National Minimum Wage (NMW) and National Living Wage (NLW). For the social care sector, where margins are already razor-thin, these changes could make or break the ability to deliver care effectively.

In this article, written by Lauren Rofe, COO at Florence, you‘ll get everything you need to get ahead of the changes, understand the financial impact, and ensure you’re not caught out.

The key changes at a glance

The government has announced the following increases:

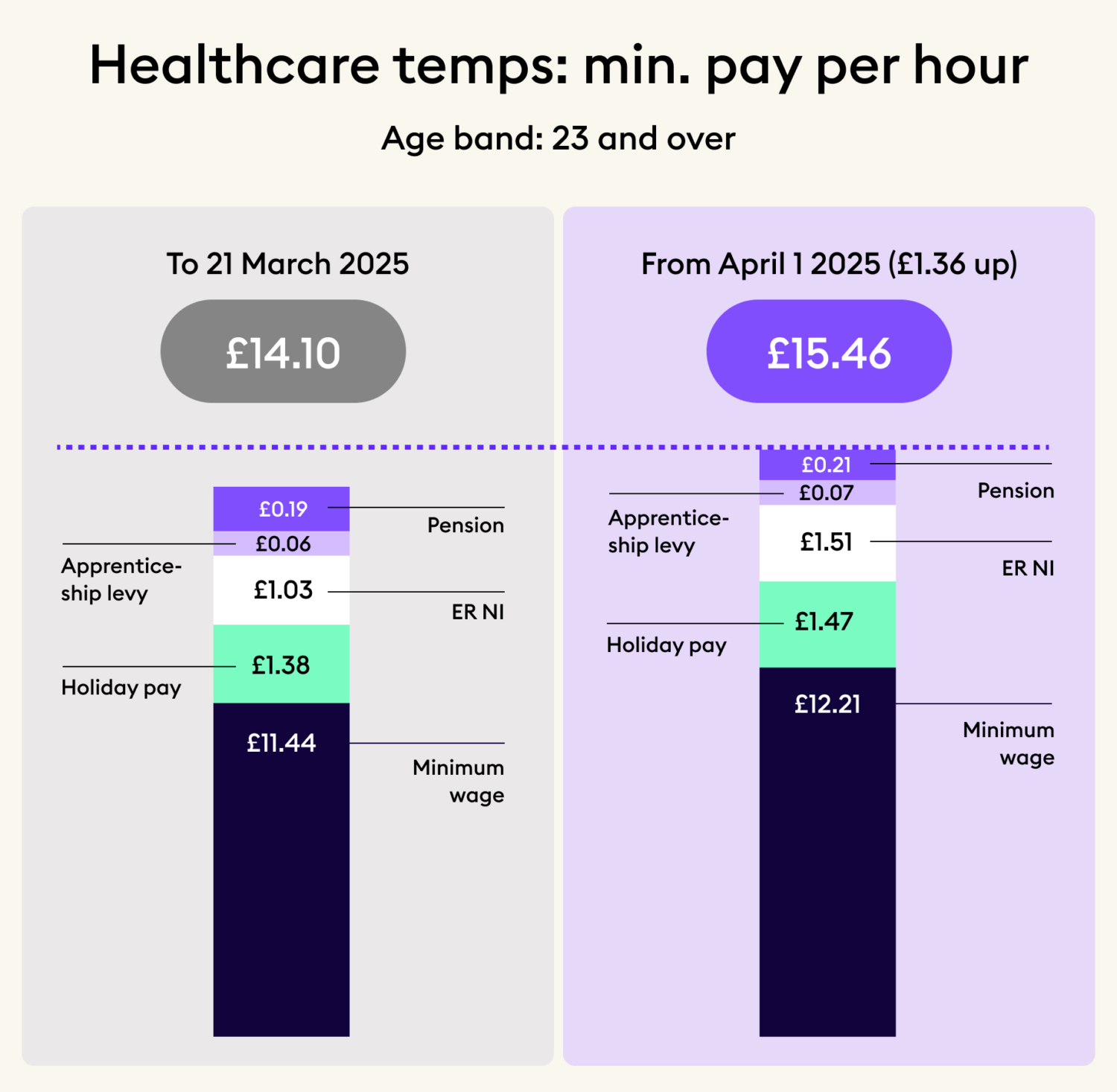

- National Living Wage (ages 21+) will rise by 6.7% to £12.21 per hour (previously £11.44).

- National Minimum Wage (18-20 years old) jumps 16.3% to £10.00 per hour (previously £8.60).

- The rate of employer’s National Insurance Contributions (NICs) will rise by 1.2%, bringing it to 15%. The specific impact on cost to employ will depend on the size and make-up of your workforce.

- The Employer’s NI Secondary Threshold will decrease from £9,100 to £5,000. This change, alongside the rate increase, means a higher NI burden for many businesses.

For care providers, this isn’t just a pay rise—it’s a financial shift that will increase operating costs significantly.

Why this matters for health and social care

Social care is already at a tipping point. Rising costs, staffing shortages, and funding gaps have left many providers questioning how long they can stay afloat. The latest wage increase is a necessary step for fair pay—but without additional funding, it places even more pressure on an overstretched system.

Martin Green, CEO of Care England, recently warned that “without sustainable funding, providers will struggle to meet rising costs while maintaining quality care.”

We’ve seen this before. Each time the minimum wage increases, there’s a surge of care home closures, recruitment struggles, and reduced capacity. The stakes are high—getting this wrong means more people left without care, longer NHS waiting times, and increased pressure on already exhausted staff.

How to avoid getting caught out

If you’re running a care service, preparation is key. Here’s what you need to do now:

- Review payroll & adjust budgets – Ensure all wages are compliant by April 1, 2025. Identify roles where pay needs to increase and factor in employer NI contributions.

- Assess contract rates – If you rely on local authority funding, check whether fees will increase to match rising costs. If not, renegotiation may be necessary.

- Prepare for workforce reactions – Carers will expect immediate adjustments. Be transparent about changes and communicate clearly to maintain trust.

- Audit your staffing agencies– Ensure that staffing agencies you are working with adhere to the changes and they are paying workers fairly.

- Look at efficiency & tech solutions – With higher costs, finding ways to streamline operations is crucial. Putting in place a digital workforce management and automation platform, like Florence, can help optimise staffing levels and reduce admin costs–it’s good to know we also don’t charge set up fees. (We’ve already saved Four Seasons Care over £2.1 million.)

- Advocate for fair funding – The sector needs urgent government support. Engage with industry groups, like Providers Unite, lobbying for increased care funding to match these wage changes.

What this means at Florence

At Florence, we’ve always stood for fair pay and transparency—it’s the foundation of how we work. We support both healthcare professionals and providers in delivering high-quality care while keeping costs fair and sustainable.

- Carers and support workers – The minimum wage increase means we’ll be adjusting all pay below £12.82 to £13.68 (including holiday pay). Any worker currently earning below this threshold will see their pay adjusted accordingly.

- Nurses – While no immediate pay rise is mandated, we are monitoring staffing levels closely and will adjust to remain competitive.

- Employer NI increases – We expect a 3% impact on costs due to NI threshold changes.

- Training remains free – We continue to fully cover all training costs for carers, averaging 69p per shift, so compliance never comes at an extra cost to you.

Note: these rates would not include any margin for staffing agencies, so rates would likely be higher.

The bottom line

This wage rise is one of the biggest in recent years and will reshape the care sector. It’s a step forward for workers, but for providers, the financial burden is real. The key is early preparation, financial planning, and clear communication with your workforce.

As a care provider, you can’t afford to wait—take action now to stay ahead of the curve.

For more updates and support on how to navigate these changes, or to discover new ways to save on staffing costs, reach out to us for an informal chat.

Book a consultation

We’re here to partner with you, that’s why we start every relationship with a consultation. Fill out your details, and our friendly team will be in touch to discuss the best flexible-workforce solutions for your organisation.